Market Update

Unemployment fall10000 to 278 000

ECB keeps the key interest rate unchanged.

Euro has very low rate inflation

Comcast: service providers slipping: Obama urge FCC to adopt net neutrality

Alibaba:

Stock price up to 120(most because of bachelor’s day). Sales volume reached 9B

Tmall recently began allowing foreign brands to reach Chinese consumers directly through its network

Kate Spade:

Shares up 15.7% last Thursday on strong third quarter earning result

Net sales grew by 30%

Strength: notable ROE, revenue growth and good cash flow from operations

Weakness: higher debt management risk

Yahoo:

To acquire video advertising company Brightroll for $640 million

Combine yahoo’s premium desktop and mobile video adverting inventory with Brightroll’s platform

Healthcare industry

Government spending out of total GDP increases rapidly in recent 30 years

$8508 personal spending on health care in 2013

Hospital mergers can lead to price increases of up to 20.3%

Enter barriers: new drug development; demand for doctors; build a new hospital

FDA: New Drug Development Process: an average of 12 years

More joint hospital overseas

4 concerns: aging population and chronic diseases; cost and quality; access to cares; technology

Numerous digital and e-health/data initiatives are gaining critical mass

Stock Pitch

DXCM

A leading company of glucose Mortaring

1999- Founded

2005- IPO ON NASDAQ

Product:

Ambulatory product line

In- Hopspital Product Line

Others

Market opportunities:

Diabetes

Importance of Glucose Monitoring

Limitations of Existing Glucose Monitoring Products

Strategy:

Research

Technology

Direct Sales

Partnership

Coverage Policies

Broad Use

Customer Service

Regulation

FDA

Fraud and Abuse Laws NAD other Compliance Requirement

International Regulations

Risk

Net loss

Research

Acquisitions

Sales

Competitors

Roche Disetronic

LifeScan, Inc.

Bayer Corporation

News

FDA Approves Dexcom Share

Collaboration with Animas AND Tandem

Wearable Device (corporation with Apple)

Category: Uncategorized

General Meeting (11/06/2014)

Market Update

The end of QE:

Officially announced last week that it end its QE program this month

Facebook:

Earning of 43 cents per share

Increase of 49% from last quarter

Facebook surprised investors, declaring 2015 a “Significant Investment Year”

Michael Kors Qtrly Earnings:

Net earnings of$1 per share on 1.06 billion in revenue.

Comparable store sales grew 16.4%, but fell short of the 19% growth forecast.

Following the release of the earnings results, shares of Michael Kors plunged as much as 11% in pre- market trading action

Portfolio Update

NTT and VZ were add into the portfolio

General Meeting(10/29/2014)

Stock pitch

Verizon communications

Overview

- Largest wireless service provider in the U.S by retail connections and revenue.

Completed 100% stake acquisition of Vodafone Group Feb 2014

- Two sections: Verizon Wireless& Verizon Wireline

Stock and Financials Overview

- Market Cap207.13B

- P/E 10.78

- EPS:4.63

- 3rd quarter report: increase in revenue

- Added 1.5 million new subscribers to its wireless service, beating analysts’ estimate.

Risk Factors

- Missed expected 92 cents per share

- Significant domestic and global competition faced by both the Wireless and Wireline segment.

- Rapid technological development and changing consumer demand

- Verizon’s has a significant amount of debt and it could further increase if Verizon incurs additional debt or does not retire existing debt.

Competitors

- ATT

- Sprint

- T-Mobile

Opportunities

- Increasing demand in mobile data and broadband service

- Strong subscriber addition:

- Wireless segment adds 1/4M postpaid connections

- Wireline: Verizon added 130,000 net new FiOS Internet connections and 100,000 net new FiOS Video connections

General Meeting (10/22/2014)

Market update

- Market trend dip last week but bounced back since 10/21

General concern in the market: increasing interest rate

- Third quarter report is out:

- Boeing shows strong 3rd quarter result: 17% increase in earning

- Yahoo’s earning exceeds expectation but not very impressive compared to other companies.

- Snap chat start to raise more money.

Stock pitch

ConocoPhillips(COP)

Overview:

- The world’s largest independent exploration and production (E&P) company.

- Explore for, produce, transport and market crude oil, bitumen, natural gas, liquefied natural gas (LNG) and natural gas liquids on a worldwide basis.

- Have operations and activities in 27 countries.

- Six operating segments defined by geographic region: Alaska, Lower 48 and Latin America, Canada, Europe, Asia Pacific and Middle East, and Other International.

- No dominating competitors for any segment of business.

- Goal: 3-5 % annual production and margin growth.

Risk

- Prices of crude oil, bitumen, natural gas, natural gas liquids and liquefied natural gas.

- Decline in volume of reserves.

- Expenses on compliance with existing and future environmental laws and regulations.

- Change in domestic and worldwide political and economic environment.

- Changes in governmental regulations may impose price controls and limitations on production of crude oil, natural gas, bitumen, and natural gas liquids.

Decline in oil price- strategic focus

- Higher cash margin developments by reducing production cost.

- ConocoPhillps produces oil and gas at comparatively low rate compare to other oil and gas producers.

Reserve

- 179%annual reserve placement in 2013

- Continue adding deep water discoveries.

- Increased production on reserves.

Balance sheet

- Has enough assets to cover liability

- Net tangible assets have been growing since 2012

Goldman Sachs On Campus Event

BACKSTAGE PASS:

CREATING CONNECTIONS IN FINANCE with Goldman Sachs

Friday, October 24 from 11:00am – 12:00pm (Thomas Hall, Quita Woodward Room)

Bryn Mawr Students Register here: https://brynmawr.qualtrics.com/SE/?SID=SV_3wL5qB2MAoDNXH7

Explore traditional and alternative paths at Goldman Sachs with Edina Jung (BMC ’94) and Jamie Higgins (BMC ’98), learn about internship & full-time opportunities, and more.

Edina Jung (Mathematics ’94)

Edina is global head of Benefits and Wellness and head of Global Mobility Services in the Human Capital Management (HCM) Division. She is the MD sponsor for the HCM Asian Professionals Network and serves as a member of the Firmwide Asian Professionals Network Steering Committee. Edina is also a member of the Retirement Committee for the firm’s US retirement plans. Prior to assuming her current role, Edina was head of Employee Special Investments and co-head of Global Benefits and Wellness. Earlier in her career, she was head of US Benefits. Edina joined Goldman Sachs in 2000 and was named managing director in 2011. Prior to joining the firm, Edina worked at ACS (formerly PricewaterhouseCoopers) in benefits administration. Edina earned a BA in Economics from Bryn Mawr College, where she serves on the President’s Advisory Council. Edina and her husband have a daughter and live in Montclair, New Jersey.

Jamie Higgins (Mathematics ’98)

Jamie manages the US Supply team within the Global Securities Services (GSS) Securities Lending Group, which she joined in 2007. Prior to that, she co-managed the Corporate Repo Securities Lending team from 2006 to 2007. Earlier in her career, Jamie worked on the Securities Lending Demand team covering hedge fund clients. She joined Goldman Sachs in 1998 as an analyst and was named managing director in 2012. Jamie earned a BA in Mathematics from Bryn Mawr College in 1998.

General Meeting (10/08/2014)

Market Updates

- Hewlett- Packard split into 2 different smaller companies. Lots of big tech companies are trying to split into small ones (eBay/ PayPal; EMC/ VMware). Main reason is to narrow down their focuses.

- Go pro Camera gifted 5.8 million toward charitable organization during lock up period.

- Chinese Insurer, Anbang Insurance Group, buys Waldorf Astoria for a Record $1.95B

Stock Pitch

AerCap Holdings N.V. (AER)

- Aviation company that engages in the leasing, financing, trading, sales and management of commercial aircraft and engines.

- December 16, 2013 announced the acquisition of ILFC from AIG.

Airline Leasing Industry

- Over a third of the world’s airline fleet is now rented and the proportion is likely to keep growing

- Many leasing companies also offer maintenance for the airlines at an additional cost.

Acquisition

- The combined company will be the largest global franchise in the aircraft leasing industry.

- Combined fleet of 1,329 aircraft and an order book for an additional 385.

- Will allow for cost savings and operating efficiencies.

- Lower tax expense.

- Future profits and synergies are expected to reduce its leverage meaningfully over the following four to five years.

Revenue

- Lease rental revenue:

- Asia/Pacific/Russia 32%

- North America 18%

- Latin America 11%

- Africa/Middle East 4%

- Europe 35%

Recent Activity

- Sold $2 billion worth of planes since December.

- Well ahead of its disposal target averaging $1 billion a year.

- Expected to meet a target of reaching a debt-to-equity ratio of around 3-to-1 by the end of next year.

- Secured operators for 90% of the planes due for delivery by the end of 2016.

Risks

- Interest Rates

- Emerging Markets

- Defaults

- Continued Demand from Airlines

Recommendation

- Buy

- Asses the result of earnings report in November

- Hold through end of December

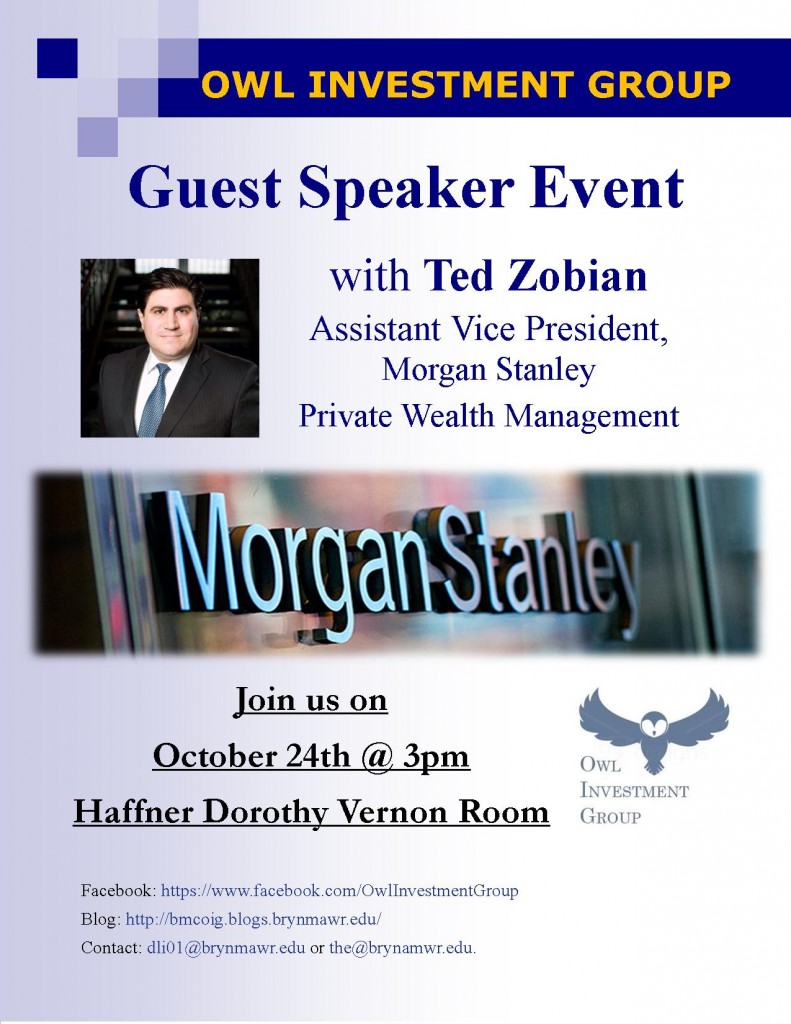

Guest Speaker Event

OIG is hosting a discussion session with invited guest speaker Ted Zobian from Morgan Stanley on October 24th @ 3pm, Haffner Dorothy Vernon Room . We welcome everyone interested to join us!

OIG is hosting a discussion session with invited guest speaker Ted Zobian from Morgan Stanley on October 24th @ 3pm, Haffner Dorothy Vernon Room . We welcome everyone interested to join us!

Ted Zobian is the assistant vice president of Morgan Stanley Private Wealth Management. He will briefly share his career path and introduce what is wealth management. Then we will open it up to a Q&A session. Don’t miss out this great opportunity!

General Meeting(10/1/2014)

Market update:

- -JP Morgan losses ruling in the lawsuit. They are facing a 13 billion settlement.

- Mortgage loan rates fell last week. However, the demand for home loan is still muted.

Guest speaker Ivy Gluck:

Ivy works as an equity analyst at Brandywine Global Investment Management after her summer internship with the company. She graduated from Bryn Mawr College in 2014 as a math major and Philosophy minor. She was also part of portfolio management team in OIG

About Brandywine Global Investment Management:

“Brandywine Global Investment Management offers a broad array of fixed income, equity, alternatives, and asset allocation strategies that seek value across global markets.”

know more about the firm:

http://www.brandywineglobal.com/Index.cfm?Page=About%20Us&Content=Our%20Firm

Key tips to Bryn Mawr Student:

- Asking smart questions. Constantly questioning things.

- Be a good team member.

- Good reading and writing skill

Job responsibilities:

- Market update through Wall Street Journal

- Company research- being aware of anything new happens in these companies in their portfolio.

- Stock research: Value investing is to seek stocks with low popularity but worth investing.

- “Fear when everyone is excited and excited when everyone fear”

- PE multiple (price over earning) analysis.

- balance sheet analysis

- Is there a reason that this company is trading very low?

- What is this company do? What is the company’s competitive position? What is its biggest risk?

Tips for internship search:

- Network through career office, lantern link, Haverford network and Linked in

General Meeting(09/24/2014)

Market Update:

- New home sales surged 18% in August.

- Sales of previously owned house falling. Therefore, investors pull back.

- The Fed on track to begin tightening its monetary policy. Investors expect interest rates to rise sometime next year.

- Apple introduces iPhone 6 and 6 plus. Over the first weekend, 10 million of new Iphones were sold.

- Alibaba, China-based Internet-based e-commerce business, goes public and it is the biggest IPO ever. Investors started buying Yahoo because it was big stakeholder of Alibaba prior the IPO. After IPO, investors dumped Yahoo! However, we will still pay more attention on Yahoo because they are expected to benefit a lot from Alibaba’s IPO as its big stakeholder.

- For more information about Alibaba’s IPO:

https://www.youtube.com/watch?v=y_9AHpoT1q

http://video.cnbc.com/gallery/?video=3000312172#.

Portfolio Introduction:

- Portfolio structure this year:

-Energy/utility

-Financial services

-Consumer goods

-Consumer Goods/ Products/Fashion

-Pharmaceuticals/Healthcare

-Technology(telecom)

Introduction to Investment

- Investment Industry Overview

-Venture Capital

-Equity/Debt (stocks/bonds)

-Private Equity

- Types of Analysis

-Fundamental

–Technical

–Top Down

-Bottom Up

Portfolio Managment Committee Meeting Open for General Members

Portfolio Management Committee invites OIG members to join the Committee meeting on Wednesdays, 8-9 pm. We hope to engage members who want to learn more about research process and be more involved in decision making for OIG’s portfolio. You could do research in advance and participate actively, or listen and observe. On the following Wednesday’s general meeting, you will give a short presentation or lead a discussion about reflection from your participation in the Committee meeting.

We are able to have up to two general members in each meeting and availability is on first-come-first-served basis, but priority is given to members who are active in general meetings. Sign up takes place in person with Portfolio Manager during Wednesday 9-10pm general meetings. You can sign up at least one week in advance.

OIG wants to see more stock pitches from general members and we appreciate your input for our portfolio building. Please join us!

If you have any questions, feel free to contact us at ywen@brynmawr.edu .